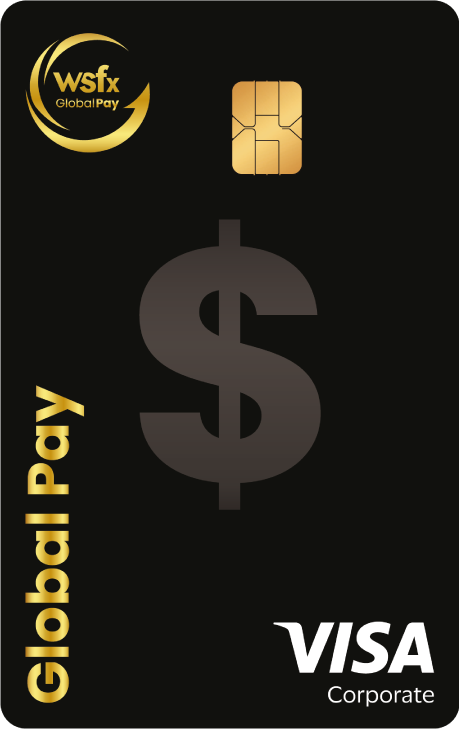

Get Your

Free Forex Card In 24 Hours!

*Terms & Conditions Apply

Hi, I want a Call Back

Your has been submitted successfully.

Our team will contact you shortly.

Safe, Secure & Seamless

WSFx Global Pay Limited (“Global Pay”), a Reserve Bank of India (RBI) licensed Authorized Dealer II, offers seamless and secure prepaid forex solutions tailored for Indian travellers. With 30+ years of expertise and 21 branches across India, we simplify international cross border payments through our forex cards, outward remittances, and currency exchange.

Choose from our five specialized cards: Global Pay Multi-Currency, Travel Pay, Global Pay Single-Currency, Student Pay, and Smart Currency. Tailored for travel, business, and study abroad, with global acceptance and complete app-based control.

Load your card with one or multiple currencies: USD, EUR, AED, AUD, GBP, CAD, SAR, SGD, JPY, THB, CHF, ZAR, NZD, HKD, and an INR Wallet.

Use our forex cards for dining, shopping, and international ATM withdrawals in any currency, anywhere.

Enjoy hassle-free international and domestic payments.

Get your forex card delivered within 24 hours*.

Reload your forex card instantly online and cash out with ease.

Make effortless withdrawals at ATMs worldwide.

Manage your forex card on the go via the Global Pay App.

Enjoy zero cross-currency conversion charges on USD card transactions.

Pick your card

Choose the best forex card for your travel, business, or study needs.

Load currency

Load one or multiple currencies online or at any of our branches.

Complete documentation

Submit your KYC documents for quick verification.

Get your card

Receive the best forex card in India instantly and activate it via the app.

Enjoy 24/7 global assistance via our helpline and app for complete peace of mind, wherever you are.

Available to Indian residents with valid KYC documents including passport, visa, air ticket, and PAN card.

You can load USD, EUR, AED, AUD, GBP, CAD, SAR, SGD, JPY, THB, CHF, ZAR, NZD, HKD, and INR (INR wallet).

Yes, you can withdraw cash at ATMs worldwide wherever VISA is accepted.

You can view your balance and transaction history anytime on the Global Pay app.

Immediately block your card via the app or contact our 24x7 support helpline for assistance.

Yes, you can reload your card via the Global Pay App or Web Portal while you are traveling; or at any Global Pay branch in India.

Simply reload your card online or via the app to continue using it without interruption.

Yes, daily spending limits apply as per regulatory guidelines and card type.

Call our 24x7 global support helpline or use the in-app support feature for immediate help.

You'll need your passport, visa, confirmed air ticket, and PAN card for KYC verification at the branch.

The best forex card in India combines zero cross-currency charges, app control, and strong security. Global Pay offers all of these features and more, making it a top choice.

A student forex card - Student Pay - is a prepaid travel card designed for students studying abroad, helping manage expenses securely and cost-effectively with added benefits like ISIC Card, Global eSIM, Lounge Access and no hidden charges.

Forex cards offer better exchange rates, zero cross-currency fees, enhanced security, and budget control, making them a smarter, safer alternative for students compared to traditional credit or debit cards.

You'll need your passport, a valid student visa, an admission letter, a PAN card, and a confirmed air ticket to apply for a Student Pay Card at a branch or online via Global Pay App or Web Portal.

Key features include multi-currency support, app-based management, chip-enabled security, global ATM access, easy encashment, and 24x7 customer support.

We offer complete transparency with no hidden charges. Transaction and service fees are clearly listed upfront and depend on the card type and usage pattern.

A forex card is generally better for international travel due to lower fees, fixed exchange rates, and added travel features; unlike debit/credit cards that incur high conversion costs.

Yes, Global Pay forex cards follow RBI regulations, including usage limits under the Liberalised Remittance Scheme (LRS). You can use your card globally within permitted limits and guidelines.

Absolutely. You can use and reload all your Global Pay's forex cards for multiple trips and destinations. It supports 14 international currencies and comes with an INR wallet for domestic use, as well.

The Global Pay Multi-Currency Card is ideal for frequent travellers, with 12 currency support, global acceptance, and app-based control.

A multi-currency forex card, as the name suggests, can hold multiple currencies. This helps you pay in the local currency of the country you are travelling to. For the transactions you make with this card, you will be protected against foreign exchange rate fluctuation.

Anyone can apply for a multi-currency forex card, including both Indian nationals and foreign nationals living in India. The documents that you need are: • Signed application form • Self-attested, valid passport copy • Copy of confirmed air ticket • Valid visa copy • Self-attested PAN copy • Additional address proof, if required • Proof of travel purpose (business, study, etc.)

Yes, you can use your forex card for online transactions just like you use your debit and/or credit card to buy things or book tickets. There are no additional cross-currency charges.